Oh Lordy. That was my reaction when I read the title of the Hartford Courant’s front page article on Sunday, Truth About Home Prices. Most troublesome were the comments posted online by Courant readers. I could feel the venom oozing out of my laptop. It seems like there are a number of misconceptions out there about seller concessions.

Oh Lordy. That was my reaction when I read the title of the Hartford Courant’s front page article on Sunday, Truth About Home Prices. Most troublesome were the comments posted online by Courant readers. I could feel the venom oozing out of my laptop. It seems like there are a number of misconceptions out there about seller concessions.

A few observations after reading both the article and reader comments…

1. The MLS covering the Greater Hartford region has used a Seller Concessions field since 2005. It was not recently created because we are seeing more seller concessions. When an agent closes out a listing once a home has sold, they indicate a “Yes” or “No” in the Seller Concessions field, based on that home sale. The agent then may or may not enter the amount of the concession.

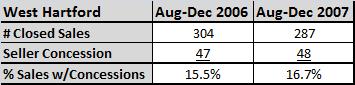

2. The article cites seller concessions for the last 4 months in West Hartford. When I pull the data for single family homes in West Hartford for the last 4 months, this is what I get when it is compared to the same time period in 2006…

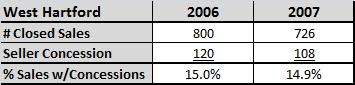

and if I look at the entire year for 2007 compared to 2006, this is what I get…

I believe it’s important to compare statistics over time rather than looking at a single observation in isolation. In this case the comparison shows that there is no meaningful difference between seller concession this year and seller concessions last year.

3. Real estate commissions are paid on the net sale price, which is the gross price less the seller concession. So the agent doesn’t inflate their commission by encouraging seller concessions. Concessions help facilitate deals and are especially helpful to buyers that are short on cash. However, sellers do pay conveyance taxes on the gross sales price, and the gross sales price is picked up when towns do reassessments.

4. As the author of the article points out, seller concessions are legal but “become sticky if the sales price of the home, with givebacks, exceeds the true value of the home as determined by an appraiser.” When dealing with concessions, the main issue is that the bank’s loan must be secured. They cannot loan more than the house is actually worth. Hence, the house must appraise for at least the purchase price, with the concessions built in. For example, suppose a house is listed at $400,000. My buyers agree to the list price, but only if the seller gives a $10,000 concession back to the buyer to cover closing costs, resulting in a net price of $390,000. The house must still appraise to $400,000 in order for the bank to fund the loan.

5. So if house prices are decreasing, then why are houses still appraising with the built-in concessions? Homes are still appraising well because they use historical data. An appraiser will use home sales that closed in the last 3-6 months when choosing comparables for their report. Theoretically, if home prices have recently decreased, the house will still appraise, even with seller concessions added on, because the appraisal is using prices from 3-6 months ago.

If prices are decreasing, in 6 months houses won’t appraise as high and sellers will have less room to give concessions. This will still be to the advantage of buyer if prices continue to fall because there is a lag and the lag will continue. However, when prices begin to rise, buyers will have to bid higher to purchase the house. Those without cash that need a seller concession to make the purchase will be at a disadvantage because the appraised values will still be tracking the market lows. The house may not appraise and the bank won’t fund the loan.

Just some things to think about as we try to deal with the data that is out there and where the housing market will go in the upcoming months.