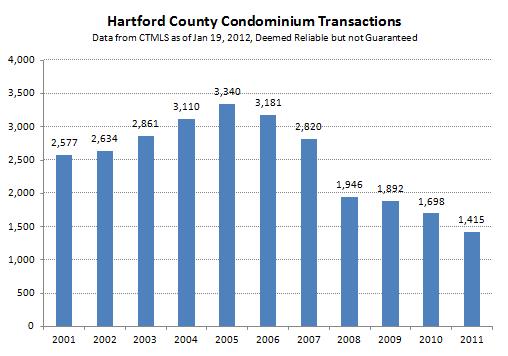

Condominiums are currently out of favor with buyers. The number of closed condo sales in Hartford County fell about 57% from its peak in 2005 to 2011.

There are many reasons why the number of condo deals has fallen so dramatically. Much of the decline can be attributed to a change in buyer sentiment, which has also impacted other property types. In the mid-2000s everyone wanted to buy a home because real estate was all the rage. Real estate was regularly in the news and was a frequent topic of conversation. And the fact that basically anyone could get a mortgage didn’t hurt either.

Buyer sentiment has changed dramatically, and the average citizen is much more thoughtful about whether buying a home is the right decision for them. Which is a very good thing.

However, buyer sentiment doesn’t explain the entire drop in condo sales. As a point of comparison, single-family Hartford County homes sales only fell by 41% from its peak in 2005 to 2011. What’s different about the condo market? Lots of things, actually, but we’ll get into that some other time.

The main point is that there are opportunities in the condominium market right now.

1. Owners need to sell, but there are not enough buyers to go around. Where single-family inventory is currently at about 6.6 months, condominium inventory is much higher at just over 9 months. There is a supply and demand mismatch in the condominium market.

2. Prices have fallen dramatically in individual condo communities. Some have found a bottom and seem to be rebounding, while others are still struggling to find a market price. This can be supported with data at the individual community level, but stats like “median price” or “price per square foot” become unreliable at the Town or County levels because the sales mix changed. The mid-2000s featured large, premium priced, new construction communities selling all their units within a couple years. The current market, on the other hand, is dominated by resales since new projects are few and far between.

We see the condo market as an exaggerated version of the overall real estate market. When real estate is in favor, condos can benefit even more than single-family homes. But when real estate is out of favor, they lose value more quickly than other property types. Based on the chart at the top, we would hope that the local markets are much closer to the bottom than to the top. Is it “The Bottom?” We have no idea, and neither does anyone else.

But we do see attractive condos out there. This seems like a good time to get into the market if you’re buying a property for the right reasons (to live in, or to rent as a cash flow investment), and you’re able to understand and feel comfortable with the additional risks inherent in the condominium market. The trick is to separate the good opportunities from the bad ones.

One factor here may be the effect of hard times on association finances. If your neighbor doesn’t mow his house’s lawn because he can’t afford gas for the mower, you don’t have to hire a lawn service. In a condo, if unit 1 can’t pay dues, Unit 2 has to pony up, or the snow plows won’t come.

I occasionally window shop for condos, and I know one thought I have is always “to what extent, and for how long, would I be committing to carry/pay back the debt amassed by the association during these rough times?” And of course you have to take the step of making an offer before you even get to see that info. It’s just an added level of uncertainty.

(Another thought I have is “do these hallways make me look fat?” but that’s not really driven by market conditions.)

I think an additional variable is FHA approval. With the recent restrictions put in place over the last few years for FHA approval of condo complexes a lot of complexes are finding it challenging to get approved. I think upwards of 35% of home sales are purchased with FHA backed loans so that takes away a pretty good segment of potential buyers.

Also, the new FHA regulations were put in place in late 2009 so that coincides with the post 2006-2007 market crash pattern shown in your graph. The complexes that were already FHA approved were grandfathered in but the approvals only last 2 years at which time the complexes have to re-apply.

Thanks for the comments, guys.

Definitely agree that the condo association finances are an important concern, Tom. It is sometimes possible to get information about the delinquency rate before making a bid; I just got that stat out of the management company for a community in which a buyer is interested in buying. Not sure about the hallways thought…

And, Solomon, I also agree the FHA approval status of individual communities reduces the buyer pool and has contributed to the decline in deals. We’re definitely seeing condo associations that don’t seem to realize how important it is to be approved for FHA buyers.

You both raise great points, and provide a nice transition to an article about how condominiums are different from single-family homes.