It’s time for a property revaluation in West Hartford, something the state requires towns to do every five years.

It’s time for a property revaluation in West Hartford, something the state requires towns to do every five years.

Revaluations can seem scary to homeowners, and are often associated with tax increases. Hopefully the discussion that follows will help prepare you for the process, so that you understand what is happening and how you may be impacted as a West Hartford homeowner.

The Big Picture

Connecticut towns generate a significant portion of their revenue from property taxes. In the 2010-2011 Budget, West Hartford expected to collect about $192 million in general property taxes, which would fund nearly 82% of the $234 million-ish budget.

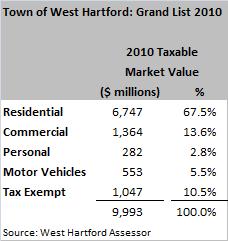

Property taxes are levied against residential property, commercial property, personal property (really business property), and motor vehicles. Just about everyone contributes in one way or another. Ideally the cost of running the town is balanced between the different constituents fairly, since they all utilize different services. As the chart to the right shows, there is about $10 billion in property in West Hartford right now.

Running the Numbers

Running the Numbers

Property tax calculations begin with a Market Value. This number is what the Town feels your home is worth, or at least what they felt it would sell for back in 2006 during the previous revaluation. Since doing a custom analysis for each and every property in town is unrealistic, they utilize a valuation model that is guided by market transactions.

Between revaluations, the main way that Market Value can change is if there have been improvements to a property. The easiest example is if someone buys a vacant lot in a neighborhood and builds a new home on it. Obviously, the property is more valuable now that it has been “improved” and the Market Value would increase to account for those changes.

Homeowners making other “improvements” to their property may, or may not, cause their Market Value to change. The Assessor’s website notes that maintenance and cosmetic changes generally do not impact the Market Value, while structural renovations or improvements may. For example, replacing a roof or furnace won’t lead to a higher tax bill. The town is more interested in knowing if you added central air, finished the basement, or built an addition. But no matter what work you do, or how it impacts taxes, it’s important for any work you do to be properly permitted and inspected.

Once the Market Value is determined, it is multiplied by a state mandated 70% assessment ratio to calculate the Assessed Value of the property. The Town uses the total Assessed Value of all property on the Grand List to set the Mill Rate so that sufficient revenue is generated to fund the budget.

People are sometimes confused about how their home’s value, the mill rate, and the budget interact to determine their property taxes. The budget sets the total level of spending — that’s what necessitates taxes in the first place. Using property values is simply a strategy for distributing the burden across owners, while the Mill Rate is a mathematical plug to make the revenue equal the expenses.

Revaluations usually shift the burden in two ways; they reallocate between property classes, and also between owners within each class. Residential and Commercial property are the two main property classes, though the chart above shows that there is far more Residential in town. Revaluations also reallocate amongst the individual property owners within a class, which unfortunately can lead to winners and losers.

The Upcoming Revaluation

The Assessor’s department has published a timeline that outlines the entire process. Right now they are gathering information for the 2011 Grand List. You may have seen the data mailers that they sent out last spring requesting information from homeowners. The goal of that mailer was to get everyone to confirm that the town had the correct information for their property.

New Market Values will be mailed out in October. Homeowners who don’t like their new values are able to schedule a meeting, called an “Informal Hearing,” to explain their position. Someone from the Assessor’s office will discuss the revaluation process and note the concerns before reviewing the value. Owners should bring documentation to the meeting to support their claims of unfair assessment.

Supporting data is very important to the dispute process. The town recently unveiled a brand new Geographic Information System (GIS) Website. It can be accessed via the Assessor’s home page, and is a very powerful tool for researching West Hartford property records.

One of the new features that was not available in the previous system is called “Sales Mapping,” which is supposed to let you pick out a property (yours) and then search for comparable sales. It may be a helpful tool, but at this point there is only sales data through 2009. The other main way to find data to dispute your Market Value is to reach out to your favorite Realtor for help.

Results from the informal hearings are also mailed to homeowners. If there is still a disagreement about value, owners have one additional opportunity to be heard, petitioning the Board of Assessment Appeals. More information about both the revaluation process and the various stages of appeal can be found on the town website in the Assessment Office area.

Hopefully the upcoming revaluation will be smooth and uneventful. Homeowners play a role in the process and need to understand how property taxes work, and how to dispute unfair Market Values.

Related Posts:

Property Revaluation Schedule for Other Towns in Hartford County

Property Taxes and Revaluations

Hi,

I’m considering moving to Farmington, to a property where I would have a view. Someone told me there is a view tax in Farmington. Is this true? How much would it be? What other Hartford area towns have this? Where can I find more information about this?

Thanks,

Erica

Thanks for the question, Erica.

Farmington does not have a view tax that is separate and distinct from the general property tax. That said, the location of a property and its views will impact its overall value, and therefore taxes.

Each town has their own process for assessing and taxing property, so if you touch base with the different assessor’s offices you should be able to get the answers you’re looking for.

Just let us know if you have other questions…