Yesterday we went over some of the reasons why the current low interest rates are unlikely to spur a dramatic wave of refinancing activity. However, trying to capture a lower interest rate may make sense for homeowners that have equity in their property, strong credit scores and available cash. Today we’re going to run some numbers to try to quantify the benefit of a lower interest rate.

Assumptions

1. Homeowner purchased a home one year ago using a 30-year fixed mortgage at 6.5%.

2. Homeowner will refinance into another 30-year fixed mortgage at a lower interest rate.

3. Refinancing will cost $2,500 in non-recoverable closing costs.

4. Ignore situation-specific factors like PMI, and unaffected factors like taxes and insurance.

Question

Would the homeowner benefit from refinancing?

Analysis

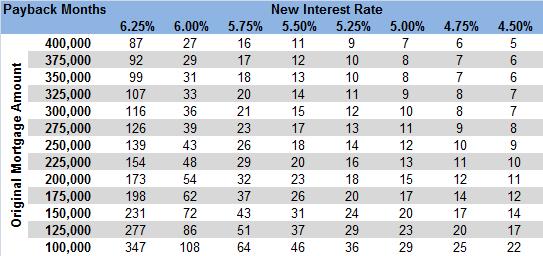

The key to understanding if a refinancing is worthwhile is comparing the savings in the monthly mortgage payment with the up-front closing costs. As long as the monthly savings are sufficient to quickly pay off the initial investment, then the homeowner benefits. I created an Excel worksheet to compare the initial investment to the monthly savings and then use those two values to calculate how long it would take for the monthly savings to pay off the closing costs.

The chart above shows how many months of lower payments (savings) it would take to offset the initial $2,500 in closing costs. Each row represents a mortgage amount (not home price) and each column represents a potential new interest rate for the refinanced loan. For example, if I had taken out a $300,000 mortgage last year at 6.5%, and refinanced to a 5.25% rate, then it would take 12 months of lower payments to recover my investment in closing costs.

Discussion

The benefit of refinancing clearly depends on the size of the mortgage. Larger mortgages have higher payments, so cutting the rate means larger monthly savings. Since the closing costs are generally independent of mortgage size (assuming the lender rolls their fees into the interest rate), the payback period is shorter for larger mortgages.

We can also see that the payback time is relatively short. If you could drop your rate by 1.0% (from 6.5% to 5.5%), then you would make back the closing costs within 2 years (24 months) for mortgage amounts all the way down to $200,000. This is another way to say that refinancing would be valuable as long as you are planning to keep your current mortgage for at least 2 years.

Finally, we should also mention the option of paying points to the lender. The points can be assessed for either origination costs or as prepaid interest. Points as prepaid interest generally allow borrowers to get lower interest rates. Paying points changes the dynamic of this calculation because they should be thought of as additional closing costs. These calculations are based on mortgages with zero points.

Despite being a simplistic approach to calculating the benefit, payback is very intuitive to most homeowners. Readers with a background in finance and/or investing may be tempted to enhance the calculations to also consider the time value of money. While I concede that this calculation may slightly overstate the value of refinancing, the difference is small for most people – perhaps a month or two. The two scenarios I can imagine where the time value of money would be an issue are if you have to pass up an incredible investment opportunity to pay closing costs, or if you believe the United States is going to experience very high inflation rates. If you have inside information about either, please feel free to send it my way.

Conclusion

A quick calculation based on a likely scenario shows that there is a benefit to refinancing, and that you don’t have to live in your home forever to capture it. If you are serious about this option, it is important to work with a mortgage professional that can first confirm that you are qualified to refinance in today’s lending environment, and then can walk you through the various options. As I mentioned yesterday, Amy and I know some quality mortgage people – don’t be afraid to ask!

Update: Changed the reason for ignoring PMI in Assumption #4 based on comments.

Hi Kyle,

I’m interested in the notion that “current low interest rates are unlikely to spur a dramatic wave of refinancing activity.”

I’m currently refinancing (I close tomorrow!) and have been told by my loan originator that the refi activity at my bank is incredibly high. (This seems to be borne out by the uncharacteristic horrible customer service I’ve been receiving, unfortunately.)

This was corroborated by my attorney, who said closings are coming fast and furious, and that banks and mortage companies have been dreadful to work with recently because they’re buried under the applications. (That customer service thing again.)

What do you think about what I’m experiencing versus your thoughts on the conditions that might make a wave of refinances unlikely?

Thanks.

Julie

Hey Julie-

Congratulations on your refi and thanks for the question!

Perhaps I didn’t give the current round of refinancing activity its due. Many homeowners are choosing to refinance, and people are definitely interested in the impact the government will have on the mortgage market. The point I had intended to make was that this wave will not be as big as the previous wave.

The Mortgage Bankers Association recently issued a press release that revises the estimated 2009 refinance activity up dramatically. However, even within the press release they note that the overall refinancing activity will still be less than earlier in the decade. I have unfortunately not been able to find a consistent data set that covers the whole decade and shows how much less.

But to your point about customer service, it’s often the lenders that are struggling to keep up after cutting back on their underwriting staff over the past few years. We’ve even heard reports that some lenders have been unable to process mortgage applications within the rate lock window, meaning that homebuyers lose their rates and don’t really have any recourse.

– Kyle

Whoa!

Lenders don’t honor their rate locks even if they are at fault?

Can you share more about this? This is very interesting to me…

We were talking with a mortgage broker (that we trust) and he shared the tidbit about losing a locked rate. I didn’t get the sense that it was common, but it apparently has happened. Unfortunately I don’t know more than that. Does anyone else have first-hand experience on this topic? Hopefully not…

From our point of view as Agents, we keep track of the various deadlines and work, with the mortgage professionals, to try to make sure it doesn’t happen to our clients.

Kyle,

You assume PMI stays the same with a re-fi, but I’ve been told that PMI rates fluctuate and, moreover, that they’ve moved up as interest rates have moved down. So a re-fi might mean a higher PMI, eating into the savings on interest payments (at least until the homeowner attains 20% equity).

Thanks, Mat. I’ll update the text of assumption #4 to change the reason for excluding PMI from the calculation. My goal for the post was to do a first-order analysis of the benefit of refinancing to a lower interest rate. The conclusion seems clear to me – refinancing will be an attractive opportunity for those that qualify. As I have said before, it is critical to work through specific refinancing situations with a mortgage professional.