That is the question. Whether ’tis nobler to suffer the slings and arrows of higher monthly interest payments, or to take arms against the current mortgage, and by refinancing, to end it.

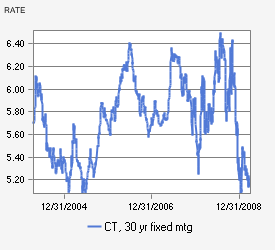

Interest rates are back down to historic low levels. The chart at left is from Bankrate.com and shows the average interest rate for 30-year fixed mortgages in Connecticut over the past 5 years. Large mortgage rate drops historically lead to a boom in refinancings, though this time may be a bit different for a few reasons.

1. Many people refinanced back in 2004-2005. There are fewer people paying an interest rate that is considerably higher than current rates.

2. Credit requirements are tighter now. Some borrowers that would like to refinance, and would benefit from lower payments, no longer qualify for a new mortgage.

3. Mortgage products have changed. Lenders are not offering the same variety of products as they were back in the housing “boom” days so borrowers would have to bring additional down payment cash to the closing.

4. Appraised values are falling. Lenders require appraisals before funding a loan because they want to be sure that they know their level of risk, as measured by the Loan-to-Value ratio (LTV). Falling appraisals also lead to borrowers bringing additional down payment cash to closing.

5. Cash is required. In addition to any cash required by the previous two points, homeowners also need to have cash available to pay for the closing and to establish new escrow accounts (for insurance and taxes) while they wait to receive the proceeds from their old escrow accounts.

6. People’s attitudes have changed. As a country we seem less inclined to talk about our financial situations, which should result in fewer refinancings motivated by social pressure to keep up with the Joneses.

With these factors as a backdrop, the first question to consider is whether you CAN refinance. If there is any doubt, and you are serious about trying, then consult a professional. There are plenty of mortgage brokers and mortgage bankers that would be willing to review your personal situation. Amy and I would be happy to provide recommendations for those that do not know someone they can trust.

Tomorrow we’ll continue on the same topic, but actually get into the numbers to see just how much money you could save by refinancing to a lower interest rate.

One thought on “To Refinance or Not To Refinance (Part 1)”

Comments are closed.