Buyer’s Week continues at the Greater Hartford Real Estate Blog, building on Monday’s look at the current opportunity and Tuesday’s suggestion to start with the mortgage. Check back each day for another post specifically for buyers.

A real estate market with falling prices is actually a very good environment for trading up to a larger home – if you can overcome your fears. Consider a simplified example.

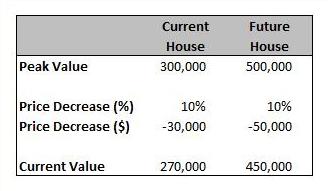

Suppose home prices have fallen 10% from their peak value for both your property and for the one you’re hoping to buy. Also suppose that you’re looking to sell a home that peaked at $300,000 and buy a home that peaked at $500,000. Although you may feel that you have “lost” $30,000 in value, using that same logic you are “gaining” $50,000 by paying less for the new home, a net positive outcome of $20,000.

Many people in this position get stuck on the peak value for their current property. It’s burned into their minds so that accepting less for their home is excruciatingly painful. Yet they don’t take the broader view and realize that other sellers are also forced to “discount” their home from peak prices.

The reality is that even though home prices have fallen in all markets, they have not fallen uniformly. Move-up buyers may be able to do even better than in the above example if they sell in a stronger town/sub-market and buy in a weaker town/sub-market. In general, higher priced homes have fallen in price more than lower priced homes, favoring move-up buyers. And some towns have definitely seen larger price drops than others.

Accepting that your property has declined in value is the first, and most difficult, step. Hopefully that is made easier by the fact that there’s a definite reason for moving up to a more expensive home. Some may need more space, others may be switching towns, and still others may be looking for a home that conveys higher status (gasp!). Whatever the reason, it is likely unrelated to current market prices.

The single biggest risk in trading up is that you’ll have bad luck on the timing – the market will fall an additional x% and you’ll have a “loss” on the new house right out of the gate. It could happen; nobody knows where the market will go next. But if you have a compelling reason to upgrade, can afford the (fixed) monthly mortgage payments, and are planning to stay in the home for the foreseeable future, then the “loss” is just on paper. You still get to enjoy the property, and it won’t impact your financial situation.

On the other side of that coin, the market may return to its peak levels by the time you’re ready to sell. Again, nobody knows. But decisions like these would definitely be easier if we could predict the future.