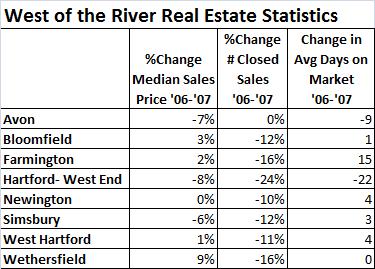

My favorite mantra in residential real estate is “the market is local.” You can read all of the national news reports you want about how foreclosures are overwhelming Ohio and Michigan and how housing prices are dropping faster than Britney’s fan base. But if you live in an economy like Connecticut with a stable job market and reasonably paced home construction, you shouldn’t expect the sky to fall on the housing market. And after doing some data mining on the local Multiple Listing Service, my research supports the fact that the local residential housing market in Greater Hartford (at least West of the River) is fairly healthy. Take a look…

First, a couple of disclaimers. The data pulled from the MLS compared April through September of 2006 with April through September of 2007. The April through September timeframe is typically the busiest time in single family residential sales for the area. Data from the MLS is “deemed reliable, but not guaranteed.” The towns I selected are all West of the River because that is where most of my reader base is located.

And the observations…

1. Only Avon, Simsbury, and the West End of Hartford have seen declines in the median sales price from 2006 to 2007. The other towns I surveyed had more typical, historical grow rates of 1-3%. We seem to be returning to normalcy.

2. Every town has experienced a slow down in the number of sales. This is most likely attributable to fewer available buyers due to the tightening on mortgage requirements and fewer people willing to sell because they are either concerned they “missed the market” or reassessed their need to move-up to a different price level.

3. The time it takes to sell a home has not drastically increased. Farmington saw the most dramatic increase with about 2 weeks added to the average length of time it takes to sell a home in that town (which was 54 days in 2006). Avon and the West End of Hartford have actually seen houses sell faster in 2007 compared to 2006, but unfortunately for a lower median price.

So, for the most part, median price increases are healthy in towns West of the River. But will prices continue to remain stable? Unfortunately there is no way to time the bottom of the real estate market, just like there is no way to determine exactly when to sell a stock. If you’re thinking about buying a home right now, make sure your agent does a market analysis of recent sales (the last 3 months) when you are formulating your offer price. Understand that buying a home should be a long term investment, at least 3-5 years, and that you probably can’t expect to see gains similar to what happened in 2004 and 2005 anytime soon.