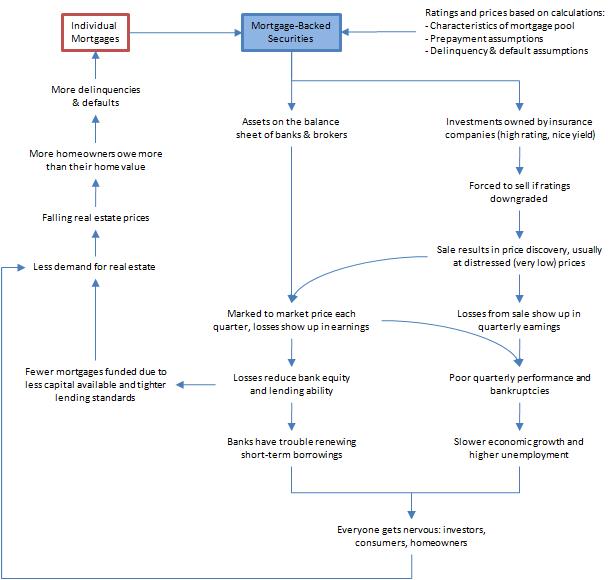

The financial markets are in a difficult place right now, and the Federal government is working on a plan to intervene and hopefully stop the bleeding. Rather than trying to figure out who’s to blame, or speculating on what might happen next, I’d like to try to illustrate the negative feedback loop currently in place.

Some observations:

1. Mortgage-backed securities are valued using computer models with numerous assumptions. The historical data used to generate the models and assumptions is not relevant in this unique environment. So there is no reliable way to put a value on a particular mortgage-backed security.

2. Few investors want to buy mortgage-backed securities right now because they have no idea what to pay.

3. Some investors are being forced to sell their mortgage-backed securities due to ratings changes. They basically have to accept whatever bids exist.

4. Sales of mortgage-backed securities are few and far between. Yet the few that get done establish a “market value” that everyone else then has to use to calculate the “losses” on their mortgage-backed securities.

5. All of these “losses” are causing severe disruptions to the businesses of banks, brokerages and insurance companies, in some cases threatening their viability.

The big implication is that demand for real estate is down due to broad concerns about the economy and the credit environment. And when demand is down, home prices are also under pressure. That’s not to say home prices are going to decrease everywhere, (since real estate is always local) just that they are facing a headwind.

It will be interesting to see how the government plans to break the negative feedback loop. The details are still sketchy at this point, but it seems to me that they could step in at a number of points. Hopefully this will be the beginning of the end of the current credit crisis, but only time will tell.