Yes, we know we are dorks. You know we are dorks too and it doesn’t hurt our feelings if you call us that. And we also know that you like these data posts, so you are at least a little dorky too. Don’t worry, we won’t tell anyone…

The local MLS that we are members of has been collecting data electronically since 2000. We thought this would be a good opportunity to do a data dump and see what’s happened during the last 10 years with single family real estate sales in Hartford County.

One of us (not Amy) had the enviable task of downloading 83,605 records regarding closed single family sales in Hartford County from the period of January 1, 2001 through December 31, 2010. As always, all of the data we’ll talk about is from the CTMLS and is deemed reliable but not guaranteed.

What was the most expensive home sold (publicly) in Hartford County during the last decade? Well, that sale took place in September 2003 when Mike Tyson sold his Farmington home for $4.1 million. That house, currently owned by the rapper 50 Cent, is now listed for sale at $9.999 million.

Yeah, yeah, we know all about 50 Cent and the smack people talk about his house. What was the second most expensive house then? The second most expensive house publically sold in Hartford County went for $3.92 million in Avon in May 2007.

How many houses sold over $1 million in the last decade? Five hundred twenty six houses sold for $1 million or more since 2001 in Hartford County. The top ten most expensive homes sold were all in Farmington or Avon. Out of the top 25 most expensive homes sold, all but four of them were located in Farmington or Avon. So, if you need a really expensive house in Hartford County, it’s probably best to start your search in Farmington or Avon.

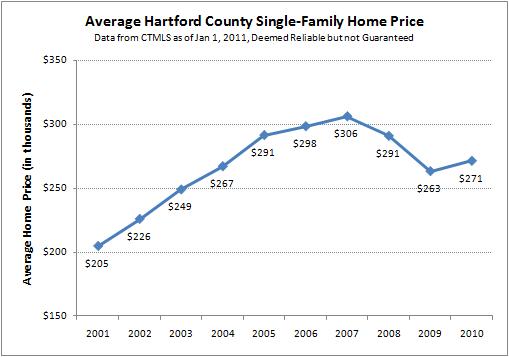

Alright Amy, we’re not all millionaires here. How about some charts about how sales prices and sales volume changed in the county over the decade…

So…

1. Average prices peaked in 2007.

2. Average prices bottomed in 2009 and rebounded in 2010.

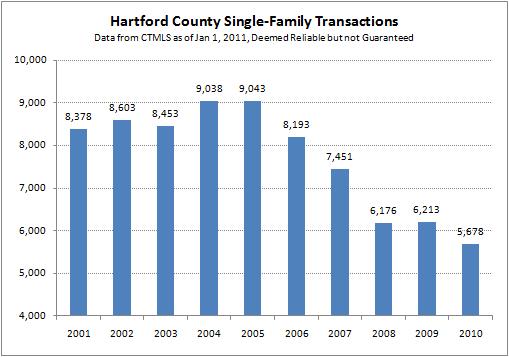

3. Transactions peaked in 2004-2005.

4. Have we seen the bottom for the number of transactions?

Why do prices continue to rise in 2006 and 2007 even as sales volume was already falling? We have some theories, but need to do some more research. Is it herd mentality? Was it new construction continuing to come onto the market? Do other markets (like the stock market) also exhibit this behavior?

What does this imply for buyers sitting on the sidelines waiting for the bottom? Have they missed it? Or is the price increase in 2010 attributable to mix of sales?

It seems as though people just aren’t moving as much as they used to. The recent trend of 6,000 deals per year in the County is well below the nearly 9,000 deals per year that were happening from 2001 through 2006. Maybe people used to move hither and thither for jobs, but now they don’t. That’s a lot fewer real estate deals for us agents to divide up amongst ourselves.

As often happens, we came out of this with more questions than answers. What do you guys think – any theories? Maybe we’ll follow up on some of these if we reach any conclusions.

Also, we have this data broken down by every single town in Hartford County. If you’re interested in a specific town, email us and we’ll send you the charts.

It seems for Hartford County there is some stability of population and business over this period. In other words, we did not grow much in terms of population, and there were no really signficant economic factors such as a large business(es) relocating into this area – or a local business growing rapidly and making lots of money – factors that might account for a jump in transactions or a particular influx of people who could buy houses. So I tend to think the low interest rates, availability of credit etc., and relatively good economic times in the early part of the decade accounted for the growth in the number of transactions- people already here moving to bigger places – and perhaps a slew of first time home buyers to take up what was left by those trading up, and at least some number of flippers lured by the potential returns.

I think there is still a fair amount of uncertainty regarding the sustainability and depth of the economic recovery generally which will continue to make people more conservative than in earlier years. This may be a good thing over the long haul – as are higher savings rates etc. In the short term, if these shifts occur, it will be a slower retail and real estate economy. Thankfully Hartford’s large employers seem to be doing ok – UTC, Aenta, The Hartford, Travelers. Personally, I see 2011 as being flat or a bit lower in volume for real estate. As to average price – probably flat or small amount higher.

April – July should be interesting to watch.

Let me make sure I understand your points. No true boom in this area, just increased confidence from a strong economy in the early/mid part of the decade. And a much more conservative attitude now given the current economic uncertainty (but not disaster).

Coming back to the real estate implications, do you think we’ll see homeowners looking to downsize from their move-up homes? Or will financially stretched homeowners try to ride it out since their homes have likely lost value since their purchase? It’s a difficult call for a lot of owners, especially since many bought with low down payments, so they may currently owe more than the value of their property.

Yes- there was nothing particular in the fundamentals of this area that represented a boom as compared to other areas – but this area did experience the same general forces that tended to cause more real estate transactions across the country and higher prices ( and some would say an unhealthy bubble) — being very low interest rates, speculation, easy access to credit, etc – all the stuff we’ve been reading about for the last couple years. This was overlaid on a relatively healthy economy which generated a high degree of consume confidence. Luckily, this area had nothing of the same more hyper-dynamics as areas of particularized growth and speculation such as South Florida or parts of California.

I’m not sure if we’ll see a lot of transactions driven by voluntary downsizing (as opposed to foreclosures) or not in this area. If there is a double dip recession (probably unlikely from what I read) then you would surely have more distress-based transactions. If not, and things improve or simply stay stagnant, I tend to think most people who don’t have to move or want to move, will hold on and resist doing anything — using a combination of refinancing and the reallocating their resources. For those that need to move or just really want to move, they may simply have to adjust to lower expectations, including taking a loss or just breaking even if they purchased within the last 5 years.