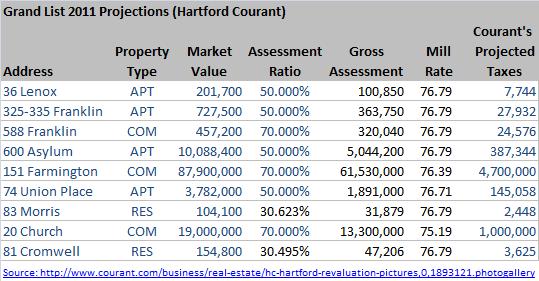

Thursday’s Hartford Courant contained an article and photo gallery projecting possible tax bills for a number of different properties in the City of Hartford. Their story contained just enough information to figure out what their model of the revaluation’s results say about the mill rate and residential assessment ratio.

Thursday’s Hartford Courant contained an article and photo gallery projecting possible tax bills for a number of different properties in the City of Hartford. Their story contained just enough information to figure out what their model of the revaluation’s results say about the mill rate and residential assessment ratio.

The Courant is projecting that the three property classes will have assessment ratios of 70% for commercial, 50% for apartments (which now includes four-family buildings) and 30.6% for residential (condos, single-families, two-families and three-families). They expect the mill rate to be somewhere between 76 and 77, and used 76.79 in their calculations.

Hartford property owners interested in estimating what their July 2012 property taxes based on this model can use the following formula:

So for a residential property this comes out to be…

… which is about the same as …

Owners of commercial and apartment properties would need to start with the first formula and plug in the appropriate assessment ratio.

Since we are still in the early stages of the revaluation process, this is a rough estimate and a lot can still change before tax bills go out at the end of June of next year.

Thoughts & Observations

The most challenging part of modeling the Hartford tax system is getting the residential assessment ratio correct. For the coming year it is supposed to be set so that the overall tax burden of residential property class increases by 3.5%. That was a compromise agreed to by the various stakeholders last spring and passed into law by the state legislature. The primary article attributes the 30ish percent assessment ratio to City Assessor John Philip, and lead author Jenna Carlesso confirmed that he provided that number.

The Courant is forecasting that the mill rate will actually increase under the new system. This is a bit of a surprise since the City’s overall goal is to start reducing the mill rate in order to help attract more businesses.

Although it seems counter-intuitive, it’s okay if the mill rate rises. The data clearly shows that the tax burdens for commercial property owners is decreasing, which is more important than the perception caused by the slightly higher mill rate. In the previous system we had an additional layer of complexity called the Business Surcharge – an additional tax over and above the standard tax – that is now gone. The City has taken an important first step to making the commercial mill rate directly comparable to other towns in the state.

Since the City Assessor has not come out with an official set of projections, we think it is important to continue to develop our own model on what could happen. We’ll keep trying to get data from the Assessor and hopefully have a second set of projections to share in the coming weeks.

Presumably the Courant team succeeded in getting additional information from Assessor Philip as inputs to their model. In thinking about repeating the calculation on our own, we don’t see any way to accurately do it without knowing the aggregate market values for each property class for both last year and this year. Last spring the previous City Assessor provided us a good amount of information, but not the breakdown of the residential class. Since the rules of the game changed to move four-families from the residential assessment bucket to the apartment bucket, we would need to calculate the impact of that change before being able to distribute the tax burden correctly and arrive at a potential mill rate.

Using the Courant’s Data to Calculate Their Projected Mill Rate

For those that are curious, here’s how we used the data that the Courant published to back into the mill rate and residential assessment ratio they are projecting.

After inputting all the data into a spreadsheet, we focused on the commercial and apartment properties. We knew the assessment ratios, so we were able to calculate the assumed mill rate. Once we knew the mill rate, we were able to use that in the residential properties to calculate the assessment ratio. Fortunately the values were consistent across all 9 properties once rounding errors were considered.

Here is our table, the cells with blue text are inputs while the cells with black text are calculations.

Related Posts

Hartford’s Revaluation 2011 – Update

Overview of Hartford’s Property Tax System