A while back we talked about how appraisals can impact a deal. A new twist is that buyers have recently been making their offers more attractive by voluntarily removing the appraisal clause. They take the risk that the appraiser finds that the “value” of the home to be less than the contract price, and they have to bring more cash to the closing. Today we’re going to quantify that risk.

Banks require appraisals to help confirm the loan-to-value ratio for a deal. For example, if the deal is supposed to have a 20% down payment and 80% mortgage, then those values have to tie back to the purchase price. If the appraisal value is less than the contract price, then the bank will only lend on 80% of the appraisal value.

Banks require appraisals to help confirm the loan-to-value ratio for a deal. For example, if the deal is supposed to have a 20% down payment and 80% mortgage, then those values have to tie back to the purchase price. If the appraisal value is less than the contract price, then the bank will only lend on 80% of the appraisal value.

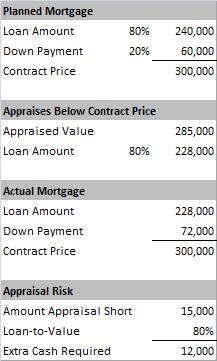

Suppose a buyer and seller agreed to do a deal for $300,000. This buyer is getting a conventional mortgage with a 20% down payment, so they’re planning to put $60,000 cash into the deal while borrowing $240,000 from the bank. If the appraiser agrees the home is worth $300,000 or more, then everything will be fine.

The more difficult situation is if the appraiser feels the home is worth less than $300,000. Suppose the appraiser determines the “value” of the home is $285,000 instead of $300,000. Continuing with the example, the bank would only be willing to lend 80% * $285,000 = $228,000 for the mortgage. The buyer would need to come up with an additional $12,000 in cash ($240,000 – $228,000) in order to maintain the 80% loan to value loan that the bank is committing to fund.

Generalizing to any situation, the appraisal risk equals:

($300,000 – $285,000) * 80% LTV = $12,000

Hopefully going into an offer the buyer’s agent has a good sense of whether or not the property will appraise, so that buyers can make a conscious decision about whether or not to include an appraisal clause in the bid.

One final note, this really only applies to buyers using a conventional mortgage. Buyers using FHA loans do not have the option of waiving the appraisal clause, which makes sense since the FHA program is geared towards helping those without much cash for a downpayment qualify for a mortgage.

This might be a good indicator of a rebound in housing prices. If enough buyers begin removing appraisal clauses from their offers, then this will relieve some of the downward price pressure of low appraisals, thereby giving appraisers higher comparable sales for future appraisals and, in turn, make it more likely that houses will appraise at or above the agreed-upon purchase price.