We’ve been thinking a lot about mortgages lately. Something that jumps out at us is just how much of an opportunity the combination of declining mortgage rates and falling home prices has created for buyers.

Interest rates for 30-year fixed mortgages were around 6% during the early and mid-2000s when we bought our house. Those same loans are now available for interest rates of 4% or less, and 15-year fixed mortgages are available for just over 3%.

But what does this mean in practical terms? How can a buyer use this to their advantage?

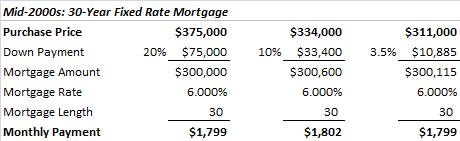

First, consider a buyer with fixed monthly budget for the principal and interest payments of their mortgage of $1,800. Here is how much a buyer could pay back in the mid-2000s for a home within the $1,800 per month budget if they had the cash for 20% down, 10% down and 3.5% down.

I don’t know how much interest rates varied based on the down payment amount back then, so that assumption may not be exactly right. But I am often surprised that in today’s market everyone gets a very similar interest rate no matter how much the put down – as long as their credit is good – so let’s go with it for now.

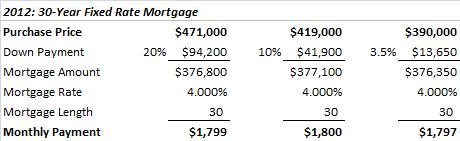

Fast forward to today … how much additional purchasing power does a buyer have when lower interest rates are factored in? Keeping the monthly budget at $1,800 we can see that the buyer with 20% down can spend almost $100,000 more. Which, when the falling prices are considered, is a meaningfully better home than they could get for the same monthly payment in the mid-2000s. Those with 10% and 3.5% down also see a bump in their buying power and an ability to get into a nicer homes.

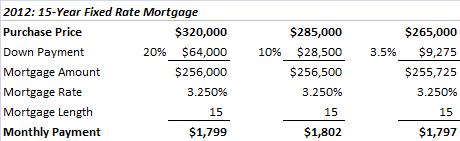

Buyers also have the option to go more conservative. Rather than using low interest rates to increase their purchase price, buyers can instead cut the length of their mortgage in half with a 15-year fixed rate loan.

The shorter mortgage does decrease the amount that buyers can spend, but some of that decrease is offset by the declines in market values since the mid-2000s. Sticking with the 20% down buyer, they are now looking at a $320,000 home instead of a $375,000 home. In most local towns that will not be quite as nice a property, but it’s a modest step down rather than a dramatic one. Is it a worthwhile tradeoff for debt averse buyers? Definitely.

It’s an interesting exercise to consider the possibilities, though not a perfect analysis. We’ve excluded the property tax and homeowners insurance escrows for the moment, since they vary from town to town. Both have undoubtedly risen since the mid-2000s, and do factor into the monthly budget. Even so, there is still an opportunity here.

Most buyers seem to be sticking with the 30-year fixed loan for their purchases. Existing owners tend to be the ones refinancing down to the 15-year mortgage, cutting 10 or more years off their loans while taking on a modestly higher payment.

My parents said something over the weekend that put this in a different kind of historical perspective. We were talking about the short-term rate of less than 3% that we’re trying to take advantage of, and they noted that they had never had a mortgage rate of less than 8% on any of their homes. Kinda makes the 6% and change where we started our journey seem reasonable…

Related Posts

The Appraiser is Coming!

Mortgage Rates and the Fed

Refinancing Our House

Refinancing Our House – Journey Underway

Refinancing Our House – Journey Completed

Mortgage Rates are Low

To Refinance or Not to Refinance (Part 1)

To Refinance or Not to Refinance (Part 2)