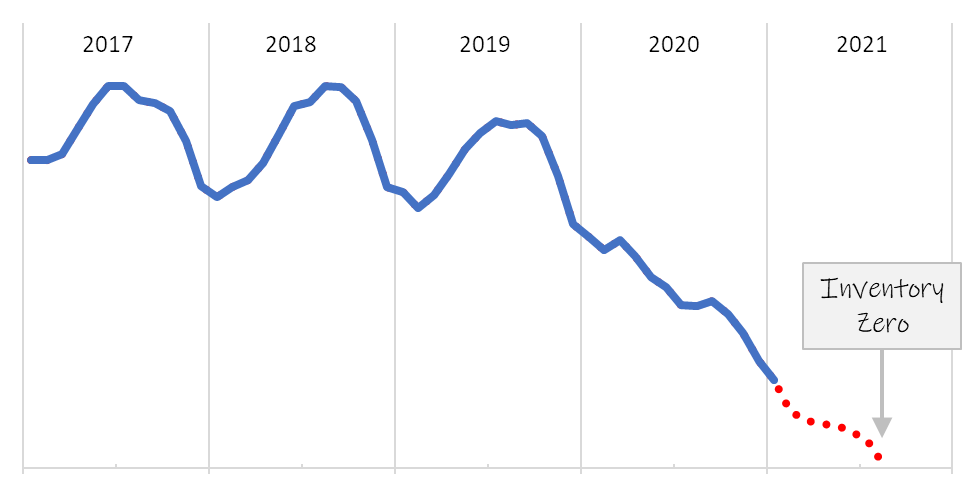

Inventory Zero: When there are no more houses available for buyers to bid on.

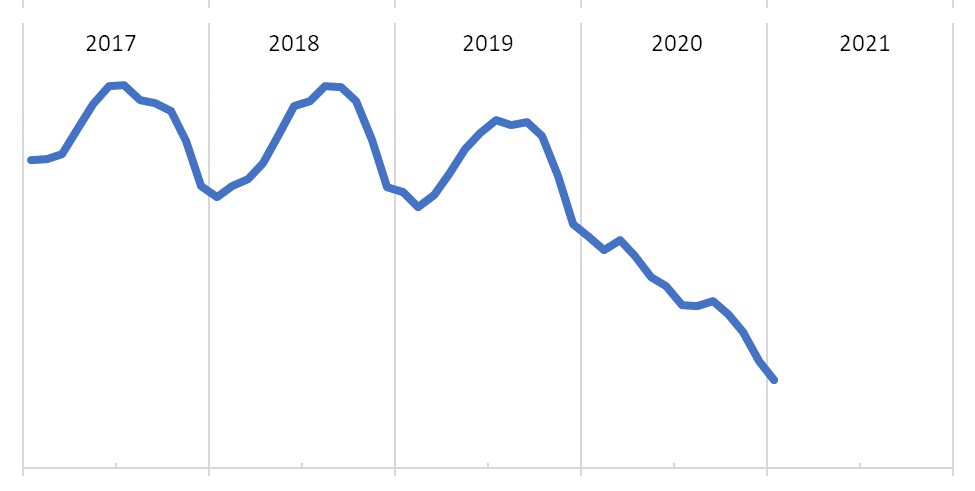

The Greater Hartford real estate market enters the spring of 2021 in a precarious position. Inventory of available single-family homes in Hartford County was driven sharply down in 2020 by the combination of extremely high buyer demand and moderately low seller supply. The chart below shows the active single-family listings in the County on a monthly basis going back to 2017.

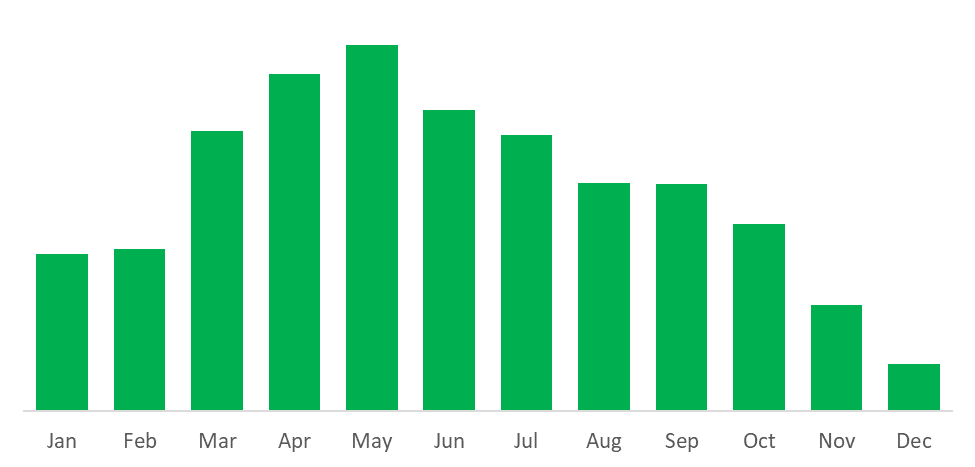

Historically, supply and demand were balanced in a way that allowed overall inventory to fluctuate within a modest range. There was a seasonality to the market. For example, here was the pattern of net new listings in 2019 (our last normal year).

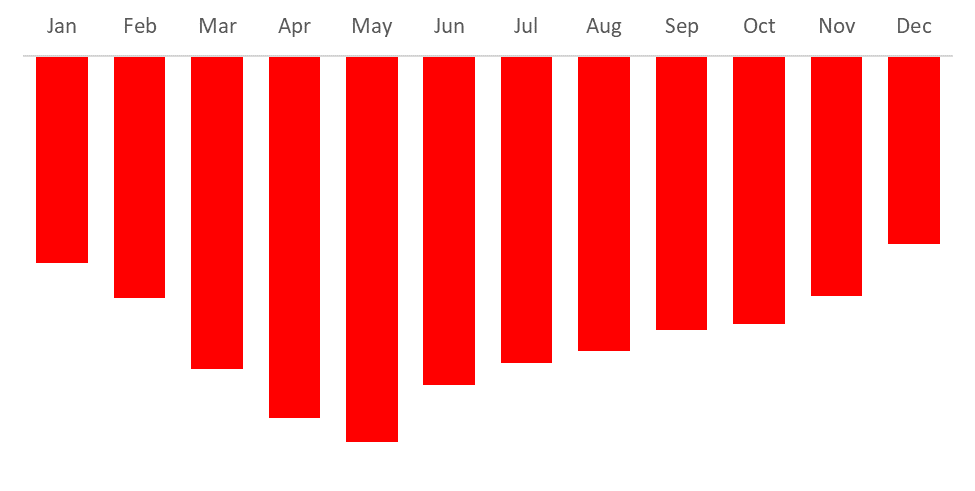

Sellers got their homes onto the market in time for buyers to bid on them and put them under contract, removing them from active inventory. Here was the pattern of contracts in 2019.

The net result was the cyclical pattern shown in the top chart. I should note that up to that point, 2019 was the fourth busy real estate year in a row, with activity levels approaching the peak from the mid 2000s. It was a strong market, and one that we hoped would extend into 2020.

2020 did end up building on 2019, but in its own pandemic influenced way. Buyer demand for homes was shockingly high, closed sales jumped by 15%. Seller supply, in the form of new listings, did not keep pace.

Listing data is noisy because agents tend to relist homes that have not sold. So a new listing is not always a new property on the market. Without taking into consideration relists, the gross number of listings fell by 6% in 2020 compared to 2019. If one deducts the homes that were taken off the market to calculate a Net New Listings total, then 2020 had about 10% more listings than 2019. It still lagged the increase in buyer demand, but not nearly as badly.

Looking forward, it seems reasonable to project that the traditional seasonality of the market will return in 2021. We are all (unfortunately) accustomed to pandemic protocols, and our view is that there is not the political will to mandate another shutdown. Therefore, we think it makes the most sense to base forward-looking projections on 2019 data since that was the most recent year with traditional seasonality.

Initial indications from January 2021 signaled that demand from buyers remained high, potentially at 2020 levels, while new listing supply declined noticeably. Specifically, there were 552 net new listings in January 2021. That compared to 634 in January 2020, and 567 in January 2019.

Since buyer demand appears to be in line with 2020, we think it is fair to project signed contracts at 15% over the 2019 monthly totals. And since net new listing supply dropped dramatically (despite every agent ever shouting that now is a great time to list a home for sale), we think it is fair to project net new listings at 3% below the 2019 monthly totals.

Plug those numbers into a model and it tells us that the overall Hartford County single-family market could hit Inventory Zero later this spring.

It’s important to note that inventory will never actually get to zero – there are always homes on the market that nobody wants to buy. Some are priced way too high, as there will likely be opportunistic sellers who list their home waaaaaay above current market values just to see what will happen. Also inventory varies by sub-market, so we would expect buyers in the highest price points to have reasonable supply to choose from throughout the year. The fact that the market is not perfectly efficient just makes the inventory situation worse for buyers.

The biggest challenge for buyers will be the price bands between $100,000 and $500,000, which represents the vast majority of Greater Hartford’s housing stock. If there are no listings to consider, then buyers will be forced to wait for new opportunities. Some buyers will give up and abandon the market. Those who remain will compete fiercely for the properties that do become available.

Sellers, this is a big opportunity … will you take advantage?