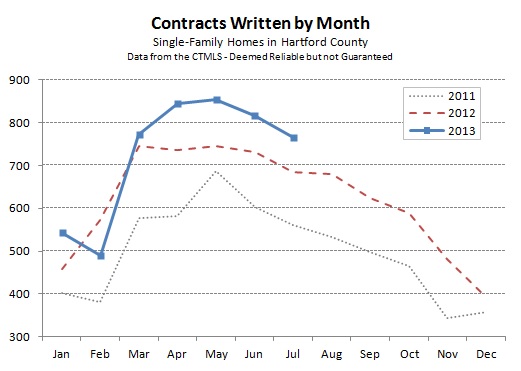

There were 766 single-family contracts written in July in Hartford County. This is an 11% increase over July in 2012, and about a 6% decrease from last month.

One important point to note is that we have revised the June contract count upwards by a significant number – see the original June post here. While working on the July numbers we found a spreadsheet error that had caused 67 contracts to be omitted from the analysis. Fortunately the big picture story for June remains the same … it was the beginning of the summer market.

July continued the summer trend with another step down in contracts. The chart shows a smooth transition from spring, and suggests the pace with which market activity may tail off through the winter. We continue to see the activity levels fall in the markets we’re currently working in too, though homes are still selling if their stats hit the sweet spot for their market and they are in good condition and priced properly.

July continued the summer trend with another step down in contracts. The chart shows a smooth transition from spring, and suggests the pace with which market activity may tail off through the winter. We continue to see the activity levels fall in the markets we’re currently working in too, though homes are still selling if their stats hit the sweet spot for their market and they are in good condition and priced properly.

The next big milestone to look for is in the September/October time frame. There is often a “fall market” that kicks off around the time that school returns to session and everyone’s weekly schedule returns to normal. Fall markets are not as active as the spring, but for buyers and sellers there is often a second wave of activity. We will see if that holds true for 2013.

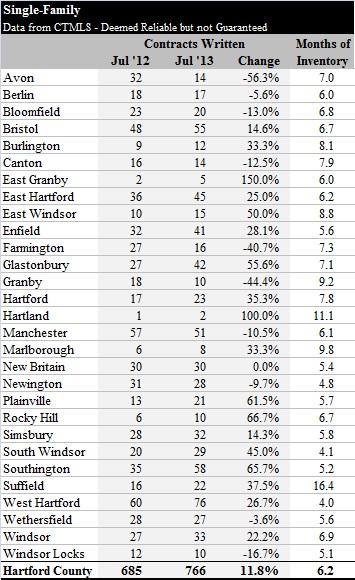

The town-by-town chart shows that inventory levels are beginning to increase. We’re up to 6.2 months for the county overall, and no towns are in the 3 month range anymore.

The snapshot for this month makes it seem like Avon and Farmington are falling behind their deal pace from last year. However, the short (one month) timeline is misleading as both of those towns are almost exactly where they were in 2012 on a year-to-date basis. It’s actually surprisingly common for a town to have a “bad” month, which is why we don’t look at pricing on a monthly basis – there is too much noise in the data to make it meaningful.