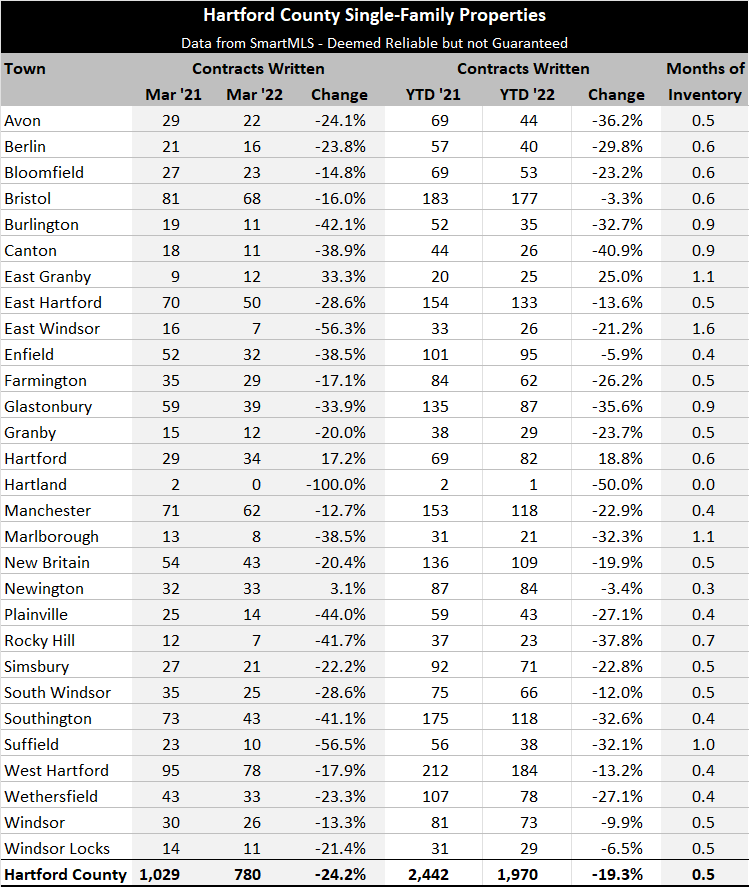

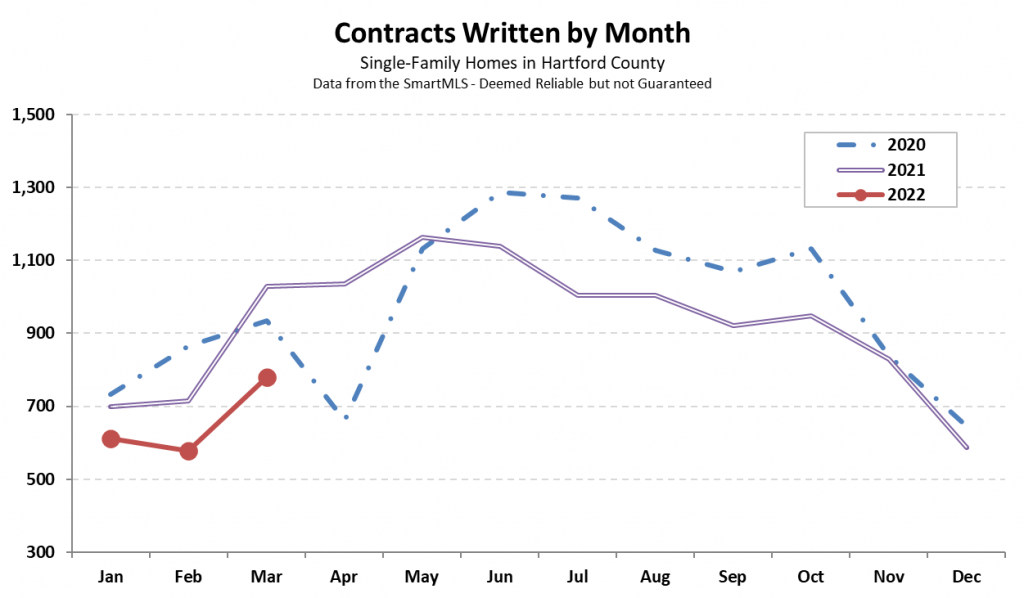

Hartford County finished March with 780 single-family contracts signed. The total was about 24% fewer the March 2021 tally, putting 2022 about 19% behind 2021 on a year-to-date basis.

We’ve written at length about low inventory. A new data point illustrating inventory challenges is that listings in Q1 were down more than 13% from 2021. Listings in Q1 2021 were down 20% from 2020. Combining those two numbers, there were 31% fewer listings in Q1 2022 than in Q1 2020 (just before the pandemic began).

The market has been brutal for buyers, especially those seeking homes in the most popular towns and neighborhoods. Winning bids tend to be well over asking prices, and non-financial terms are often also skewed heavily towards sellers.

Recent events in the financial markets, notably a jump in mortgage interest rates, could shake up the current real estate status quo. Higher prices combined with higher financing costs will push homes out of reach for some buyers that are depending on a loan.

The most competitive markets, where winning bidders often have cash offers, are less likely to be impacted than markets in which financing remains the norm. All markets could see the effect of bidders dropping out and reducing the frenzied feel that has surrounded new listings recently.

We need to take things month by month to see exactly how buyers respond. As of now, we still see incredibly aggressive buyers pulling out all the stops in order to win homes against stiff competition.