West Hartford’s adopted budget for the fiscal year running from 7/1/2022 to 6/30/2023 includes a phase-in of the recent property revaluation. The phase-in adds a degree of difficulty to calculating the property tax bill of each individual parcel.

The State of Connecticut requires municipalities to do revaluations every 5 years. The goal is to ensure that property owners contribute to the expenses of the town proportionally based on the fair market value of their property. Revaluation 2021 found that values had not changed equally for all property types since they were set during the 2016 revaluation.

To help mitigate the steep increase in values, and therefore taxes, that some owners experienced, the Town Council implemented a phase-in of the new assigned values.

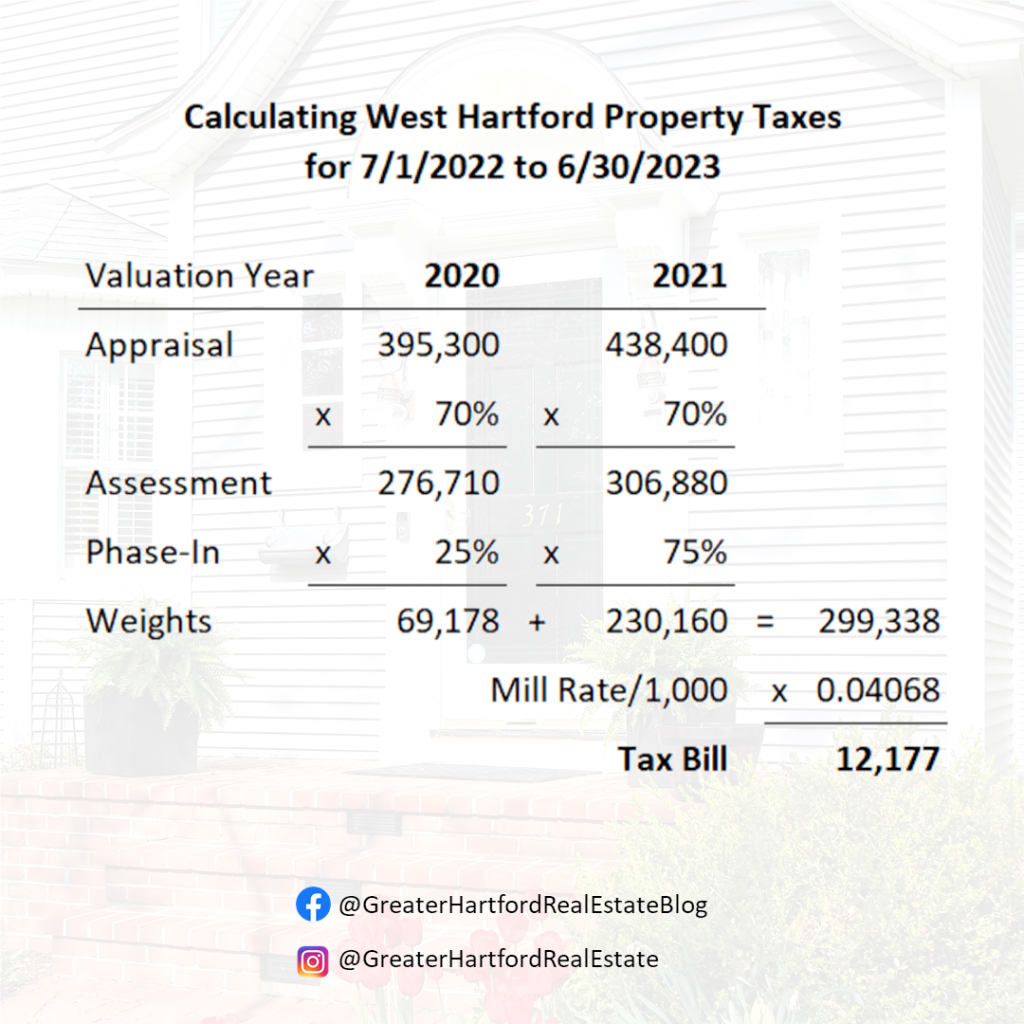

Property tax bills for the 7/1/2022 – 6/30/2023 tax year will be calculated based on 75% of the Grand List 2021 (new) value and 25% of the Grand List 2020 (old) value. The standard 70% assessment ratio will apply to both values, and the mill rate will be 40.68 mills.

The first step in calculating your new tax bill is to look up both the new and old assigned values. They can be found in the Vision database.

Search for your property and then scroll all the way to the bottom to find the Total Assessment values for each Valuation Year.

If your 2021 value is higher than your 2020 value, then continue on to the next step. The phase-in only applies to parcels that appreciated. If your property was found to have lost value, then you will be taxed entirely on the (lower) 2021 value.

Add 25% of the 2020 Assessment to 75% of the 2021 Assessment to find the Weighted Total Assessment on which the tax bill will be calculated.

Multiply the Weighted Total Assessment by the 40.68 mill rate and then divide that result by 1,000. This is the property tax bill for that parcel.

Feel free to reach out with any questions … kyleb@kyleb-re.com or 860.655.2922.