West Hartford has been one of the hottest real estate markets so far this year. Here are a few charts to show where it is as of the middle of the spring season. Data is for single-family homes and comes from the CTMLS, which deemed reliable but not guaranteed.

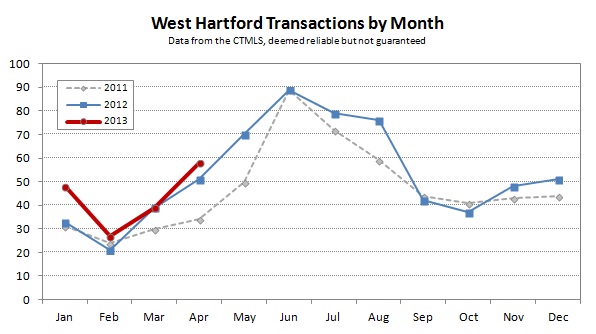

The number of closed sales has at least equaled the 2012 total in every month. Overall, 19% more deals have closed this year compared to the first four months of 2012.

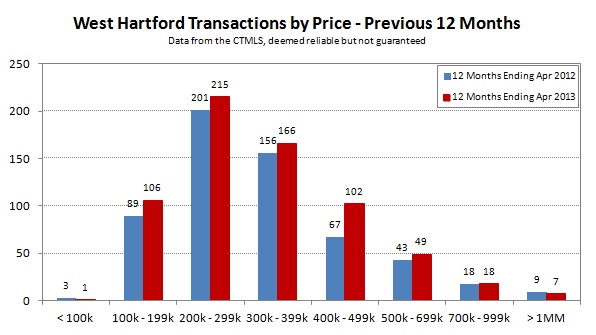

The number of closings over the past 12 months has increased in nearly every price band. The jump in the $400,000s has been especially impressive.

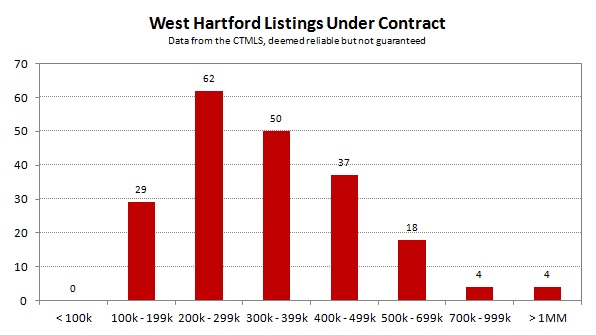

Demand for homes, as reflected in the properties currently under contract and waiting to close, is well distributed by price band.

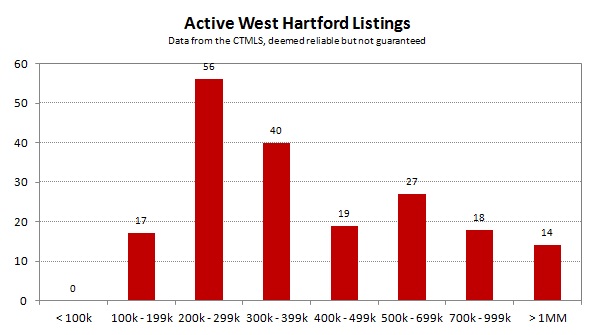

Supply of homes is limited, averaging about 3.5 months of inventory. At price points below $500,000 the market has even less available for buyers.

What these charts don’t show is that prices are increasing in West Hartford. Because every property is different, and the mix of homes that sell in a given period of time is constantly changing, there is no easy metric that captures pricing accurately. But any (active) real estate agent can tell you that bidding wars are back, and that buyers need to have their act together in order to have a shot at getting an updated home in the middle and lower price bands.

That you for continuing providing valuable information! What is interesting is the potential impact of property taxes, especially at the high end of the market. I’m hearing anecdotally that, since the full phase-in with the recent revaluation, property taxes are a significant issue with the high-end of the market. Homes that are priced at 1.2M now have taxes closing in on $30,000! Homes <$2M face taxes in excess of $60,000! Even someone who can afford a $2M homes does not want to pay taxes of $60,000 year after year. (Without question, these are some of the highest property taxes in the country on such priced homes). For the first time in many years, there is a relatively wide supply of homes <$1.5M. It will be interesting to see how this plays out. If these homes don't (or can't) sell because of the taxes, the question is whether the town will (or can) address in some way.

Hello Larry! Thanks for reading, and for the comment.

You’re right, taxes at the upper end of the market are quite high, and potentially a serious concern for buyers. In the current tax year (July 2012 to June 2013), a properly assessed home should pay about $25,000 per $1,000,000 in market value.

There are three primary strategies for providing relief to taxpayers:

1. Reduce the Town’s budget.

2. Grow the Grand List to more broadly share the burden.

3. Monkey with the assessment rules to reallocate the burden.

The focus right now seems to be to try to control the budget growth and add to the grand list, which strikes me as the ideal approach. Hartford has been involved in option #3 for some time and it’s a messy situation that requires special legislation at the state level; not a good way to go. (More on the Hartford situation here: http://www.amybergquist.com/HartfordTaxes.php)

Larry, how would you like to see the tax challenge addressed – do you have a preference?