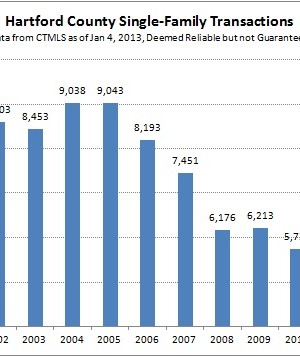

Most of our ongoing analysis of the real estate market is focused on contract data. We like to track contract data because it represents an important milestone, it is more immediate than closings, and it is a strong predictor of closings. But at the end of the year it is also interesting to take a look at the closing numbers since those data points have a meaningful price associated with them. In 2012 the number

Continue Reading

As part of our home’s 100 year birthday celebration, we learned that the original cost to build the structure in 1911 was $8,000. Starting with that data point, I tried to do some figurin’ to see how much that is in today’s dollars. Doing the calculation in my head was a very bad idea. Without actually thinking about it very much, I jumped to the conclusion that the $8,000 was “like a million bucks” in

Continue Reading

Today’s front page Courant article gives another view of the refinancing opportunity. They highlight a homeowner who is moving from a 30 year to 15 year mortgage, illustrating the significant amount of interest they can save by knocking 8 years off the total term of the loan. The story provides another great example of the line of thinking and analysis we did when working through our refinancing process. And kudos to the homeowner for aspiring

Continue Reading

I recently received this message, and wanted to share it in hopes of preventing similar situations in the future. Dear GHREB, Like you, I am a real estate agent working in the communities of Greater Hartford. I recently had an experience that has left me sad and upset, and wanted to get your take on the situation. Over the summer I sold the home of someone that I have known for many years in

Continue Reading