As those actively looking for a home can tell you, mortgage rates have risen sharply in the past two months. The chart to the right shows the average rate for a 30-year fixed-rate loan since the beginning of the year. The chart is from the Bankrate.com site. From January through the beginning of May, mortgage interest rates bounced around the 3.5% level. But then, over the course of a little more than a month they

Continue Reading

Speculating that the mortgage interest tax deduction might go away is currently quite popular. News sites all across the internet have taken various angles on what it might mean to individual homeowners and the real estate markets in general. Most articles argue that eliminating this tax break will cause home values to decrease. The National Association of Realtors is frequently quoted as estimating that home prices would fall by 15% nationally and more in areas

Continue Reading

Landlords are required to follow rules while handling the money of their tenants. One of them relates to the security deposits that they collect when someone first moves in. Tenants are supposed to earn interest on their deposits at a rate defined by the state. For many years (since 2002) the state held the required security deposit interest rate at 1.5%. This page on the CT Department of Banking site shows the historical interest rates

Continue Reading

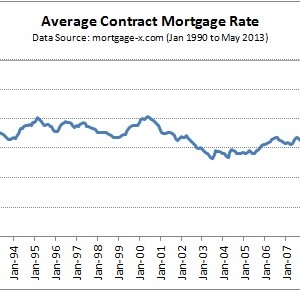

Mortgage rates are currently low. Very low. It’s common for well qualified buyers to get rates below 5%, and we’ve heard of some rates as low as 4.25% on 30-year fixed mortgages with no points. We even saw a sign by the road advertising a 3.99% rate, though it was not clear what the other terms would be. Here’s a chart from Mortgage-X.com showing rates going back to 1963, which is further than other charts

Continue Reading