As those actively looking for a home can tell you, mortgage rates have risen sharply in the past two months. The chart to the right shows the average rate for a 30-year fixed-rate loan since the beginning of the year. The chart is from the Bankrate.com site. From January through the beginning of May, mortgage interest rates bounced around the 3.5% level. But then, over the course of a little more than a month they

Continue Reading

Interest rates and down payment amounts are both trending upwards, according to recent articles on the current state of home mortgages, potentially reducing the purchasing power of buyers. After bottoming out around 4.25% last fall, mortgage rates for 30-year fixed-rate loans have recently moved above 5% for the first time in about a year. Commentators observe that rising rates will cause some buyers to rethink the advantages of home ownership, but generally conclude that they

Continue Reading

This afternoon the Federal Reserve announced the next phase of their strategy to stimulate the economy. Broadly referred to as Quantitative Easing 2, the plan involves printing a whole lot of money in order to buy long-term US Treasury Bonds in the markets. The Fed’s big picture goal is to reduce unemployment, and hopes that injecting more money into the economy will encourage businesses to begin taking risks to expand their operations (hire more workers),

Continue Reading

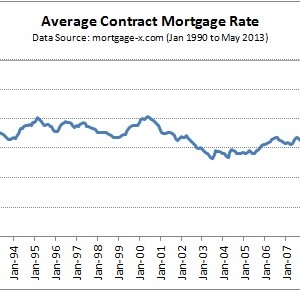

Mortgage rates are currently low. Very low. It’s common for well qualified buyers to get rates below 5%, and we’ve heard of some rates as low as 4.25% on 30-year fixed mortgages with no points. We even saw a sign by the road advertising a 3.99% rate, though it was not clear what the other terms would be. Here’s a chart from Mortgage-X.com showing rates going back to 1963, which is further than other charts

Continue Reading

Economists are divided as to the direction of the national housing market. Some believe that the environment is stabilizing and that prices will increase from here. Others see further price decreases once the government support fades away. Barry Ritholz is one economist we follow regularly, through his posts on The Big Picture blog. Right now, he has a strong negative view on the future of the US housing markets. One of yesterday’s posts broke down

Continue Reading