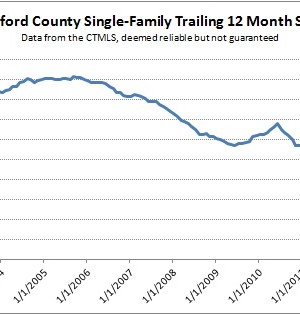

While reviewing real estate transaction data, the following chart caught our attention. It shows the number of single-family home sales that have closed in Hartford County over rolling 12 month periods. Said another way, each data point is the number of total sales over the previous 12 months. Note that this chart has nothing to do with values, only transaction counts. The line in the chart bounces around in the 8,000 deals-per-year range from the

Continue Reading

As of the first of May, the Federal Home Buyer Tax Credit is no longer part of the American residential real estate landscape. The incentive took various forms since it first went into effect in April of 2008, offering cash to both first-time buyers and existing home owners. Looking back, two questions immediately come to mind. How did the credit impact the markets over the past few years? And how will the credit continue to

Continue Reading

Last weekend I did a Home Buying Workshop at the Connecticut Convention Center in conjunction with the CT Home and Remodeling Show. It was a very interactive discussion, and attendees asked many interesting questions. Here are two questions we covered that will hopefully be relevant to a larger audience: How do I find out about open houses? There are a few places to check to find out about the open houses in the Greater Hartford

Continue Reading

I’ve been getting a lot of phone calls and emails from existing homeowners during the last two weeks. They want to know if they qualify for the $6,500 home buying tax credit that was recently signed into law. The new rules for current homeowners regarding this credit are: 1. You must have lived in your current home consecutively for 5 of the last 8 years. 2. You must have a written, fully accepted contract on

Continue Reading